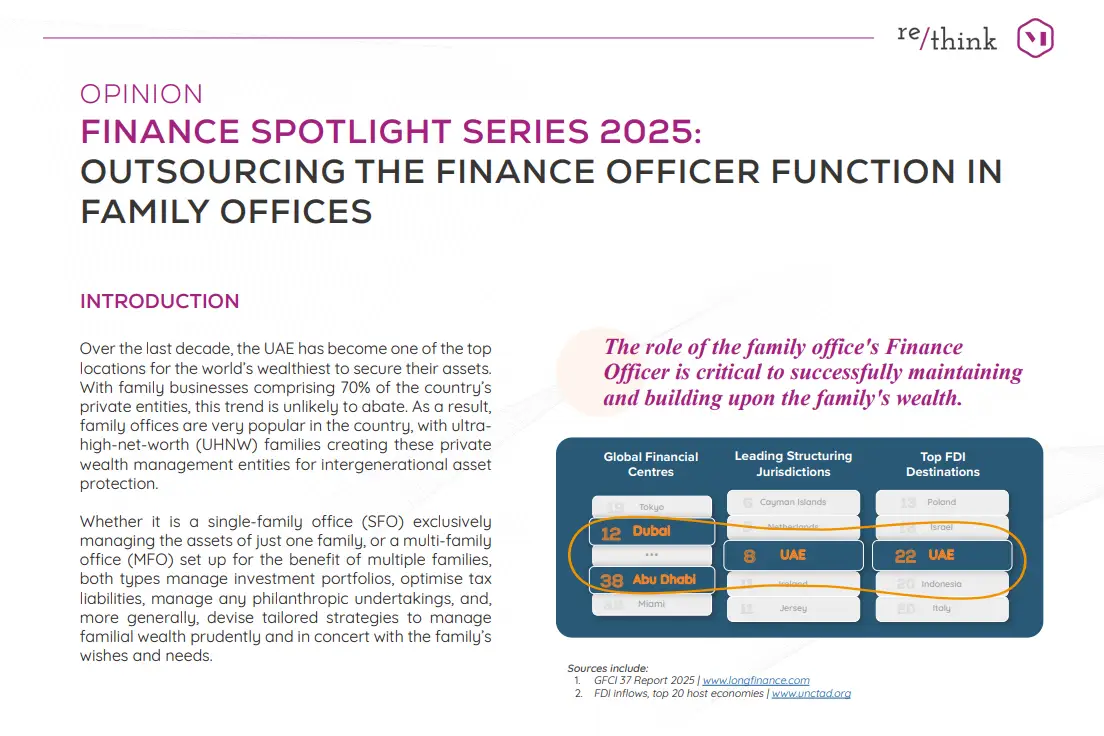

Over the last decade, the UAE has become one of the top locations for the world’s wealthiest to secure their assets. Ensuring regulatory compliance is an essential part of protecting and growing that wealth, particularly in highly regulated environments like ADGM and DIFC.

Against this background, the number of family offices – private wealth management entities set up to manage family wealth for intergenerational asset protection and growth – has increased substantially.

The role of the family office’s Finance Officer is critical to successfully maintaining and building upon the family’s wealth, supported by our broader accounting & finance services for end-to-end financial management. Whilst many emerging and growing family offices – including those moving to the UAE for the first time – outsource the Finance Officer function, other larger fully-fledged family offices may opt for a full-time, in-house resource.

Is outsourcing or in-house for your family office? Evaluate the pros and cons here.