Following the Ministry of Justice’s announcement on 10 October 2024, entities are no longer required to comply with the Economic Substance Regulations (ESR) for financial years ending after 31 December 2022.

To prevent duplication and streamline compliance, UAE-registered entities are now only required to assess their obligations and report under the UAE Corporate Tax Law (the “CT Law”). Meeting substance requirements remains necessary for those seeking certain exemptions and relief under the CT Law.

Details:

Pursuant to UAE Ministry of Justice issued Decision No. 98 of 2024, the ESR will no longer apply for financial years ending after 31 December 2022.

This allows all UAE registered entities to focus their efforts on complying with the CT Law which requires all UAE entities to:

- conduct an annual assessment of their activities, operations, and income to determine their obligations and eligibility for exemptions and relief;

- file their corporate tax return within 9 months of the end of their financial year, reporting their tax position based on this assessment.

For entities looking to benefit from the free zone relief, they must demonstrate sufficient economic presence in the UAE by meeting the following conditions which should be considered as part of the annual tax assessment:

- Core-income generating activities (CIGAs) must be carried out within a free zone, either directly or outsourced within the free zone

- Adequate staffing, assets, and expenses should be within the free zone and should align with the level of CIGAs being conducted

- The nature and scale of activities performed, and income earned, must be appropriate

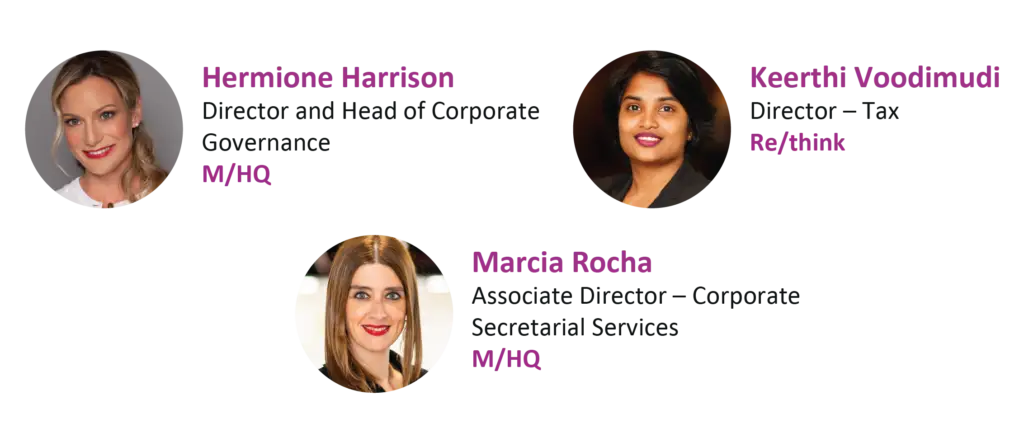

Authors

Who we are

Re/think x M/HQ is a multi-services platform catering to financial institutions as well as single family offices and sophisticated private investment companies. Our one-stop-shop offering is unique in the Middle East: a holistic and cross-disciplinary combination of a market-leading corporate services firm, a private client specialist team, and a regulatory & compliance services practice, all through one single platform.

We have extensive experience advising on a broad range of wealth structuring and legacy planning issues. We particularly assist in establishing and servicing Family- and Group- Holdings, Single- and Multi- Family offices, Foundations, and other asset consolidation/protection and intergenerational wealth management structures.

Headquartered in the UAE, we are an entrepreneurial firm for entrepreneurial clients.