Re/think provides turn-key assistance on regulated and non-regulated business setup services in ADGM.

Through our team of senior level compliance advisors, combined with legal and corporate service expertise of our local business partners, we can provide the highest quality advisory for regulated set-ups, at a competitive cost.

The key to our success and the success of a timely business set-up, is the compliance and business plan at the beginning of the process. This ensures that our clients present their plans correctly to the regulatory and /or registrar authorities.

In addition, to our services during company set-up Re/think is able to provide a broad range of services, including:

- Outsourced Compliance Officer/ Money Laundering Reporting Officer

- Outsourced Risk Officer &/or AML Internal Auditor

- Accounting and Finance Officer

- VAT advisory and implementation

- CRS/FATCA readiness assessment & support

- Targeted DNFBP support regarding policies, procedures and regulatory returns

- Assurance and Health Checks

- Regulatory Change Management & Corporate Governance reviews

- Training

STEPS TO REGULATED SET UP

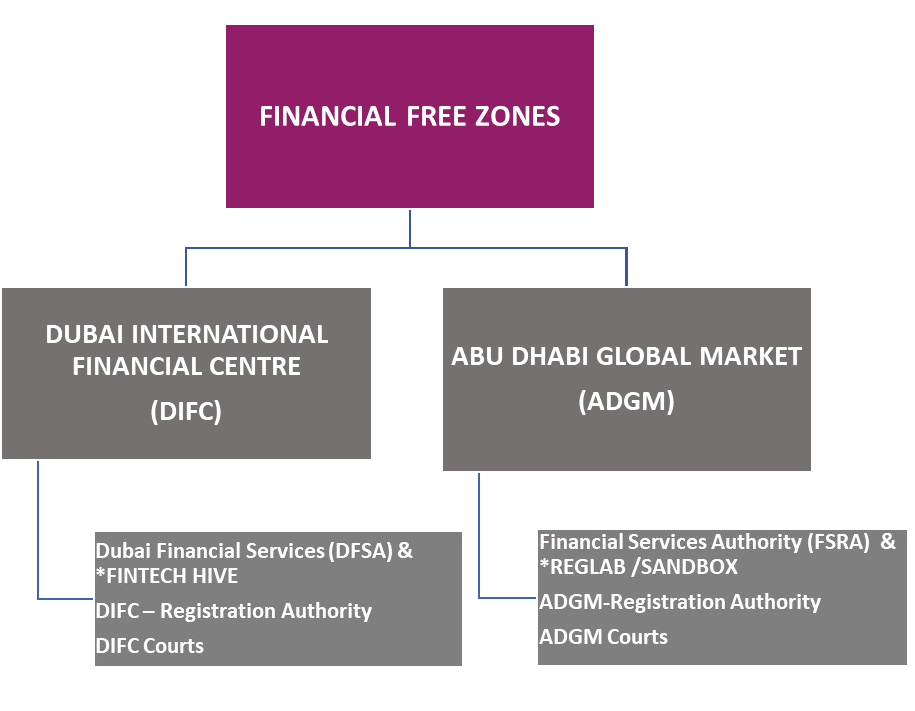

- Applicants interested in setting up operations in Abu Dhabi Global Market (“ADGM”) or Dubai International Financial Center (“DIFC”) are required to apply to the respective supervisory regulatory body i.e. the Financial Services Regulatory Authority (“FSRA”) of ADGM and ADGM Registry Authority or the Dubai Financial Services Regulatory Authority (“DFSA) and DIFC Registration Authority, which will consider the merits and suitability of the applicant.

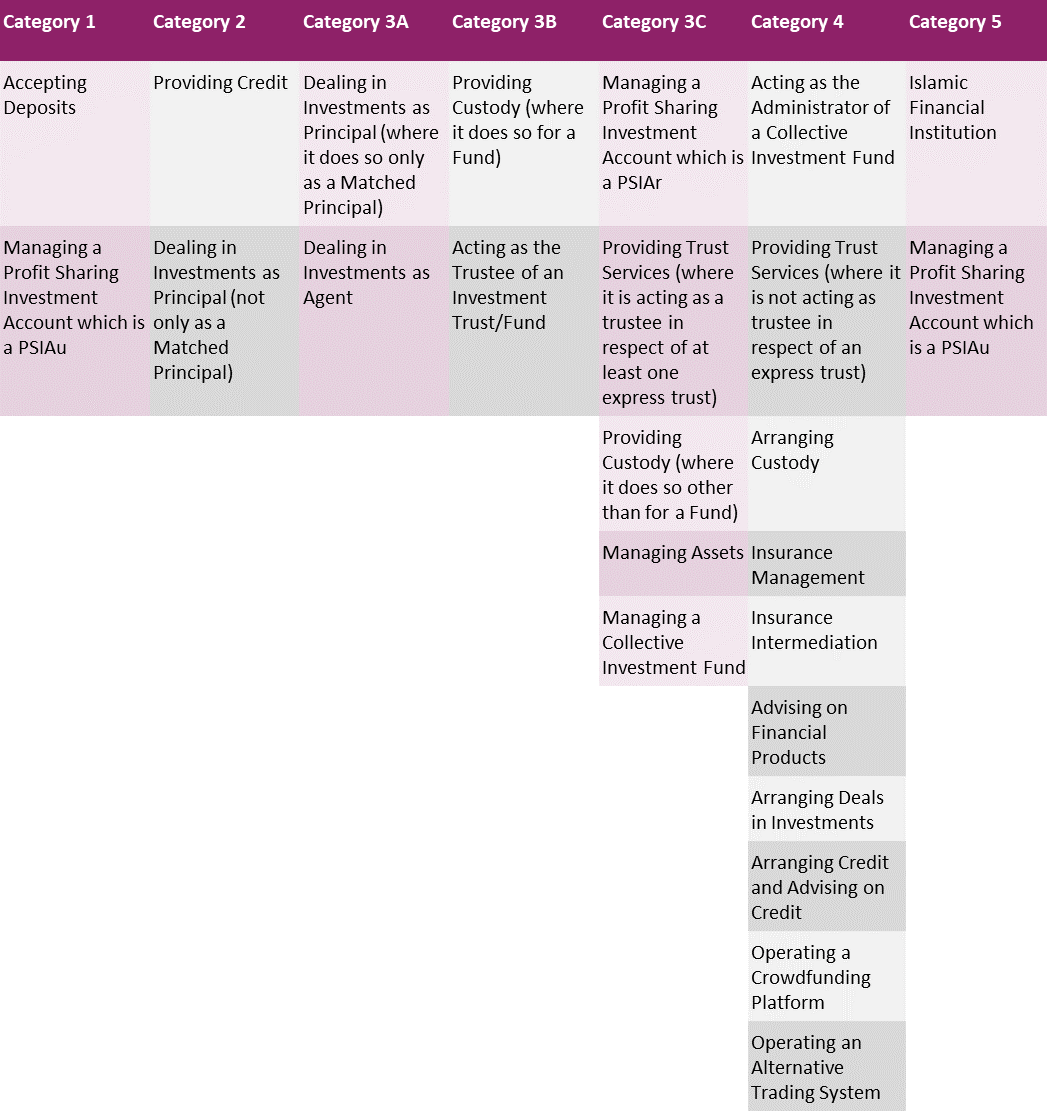

- The Applicant must choose the appropriate category of license. This will depend upon the regulated activity(ies) that the business would like to engage in.

Below chart is as adopted in both ADGM and DIFC jurisdictions:

Prior to incorporation as a company operating in the ADGM or DIFC, an Applicant must follow the process and meet all regulatory requirements appropriate to the category of license sought.

- In the initial stages of the registration process, an introductory meeting is arranged with the respective authorization team and supervisors where the draft regulatory business plan is submitted for consideration.

- Once the draft regulatory business plan is reviewed and accepted, the applicant will then be invited to submit their full application, including the finalised Regulatory Business Plan.

- Post conduct of an initial review of the application documents to ensure they are in good order and due diligence, an In-Principal Approval letter will be issued to the applicant upon satisfactorily conclusion of their due diligence of all key personnel and key touch points in the application.

- The applicant is then required to incorporate their entity, open a bank account and rent office space and confirm that they have met all pre-conditions to licensing before the grant of financial services permission to the applicant.

- The Applicant must follow the Registration Authority procedures and will be expected to provide at least the minimum information and components for the company i.e. proposed company name, proposed structure (legal (LLC, LLP, Limited by Shares), shareholding and organizational) as well as upload of all supporting documentation to the respective online portal and payment of fees.

Why the ADGM or DIFC

- 100% foreign ownership

- 0% corporate tax for 50 years

- No restriction on capital repatriation

- 0% import or re-export duties

- 0% personal income tax

- No currency restrictions

- No restriction on foreign talent or employees

- US$ denominated environment

- Added value of the respective Authorities in each jurisdiction

ADGM Authorities

- Dispute Resolution Authority (comprising ADGM Courts and Arbitration Institution)

- Financial Services Regulatory Authority

- ADGM Courts and their judiciary are broadly modelled on the English judicial system, considered a coherent, recognised and accepted legal framework. The foundation of the civil and commercial law in ADGM is provided by the Application of English Law Regulations 2015. Those Regulations make English common law (including the rules and principles of equity) directly applicable in ADGM. Additionally, a wide-ranging set of well-established English statutes on civil matters are also applicable in ADGM.

- Enforceable judgments and rulings in ADGM and throughout the UAE

- ADGM Courts do not have jurisdiction in criminal matters. Accordingly references in the English Statutes to criminal offenses have been amended to breaches of the ADGM Courts Regulation or Rules and are punishable by a monetary fine.

DIFC Authorities

- Dispute Resolution Authority (comprising DIFC Courts and Arbitration Institution)

- Dubai Financial Services Authority

- DIFC is unique from mainland jurisdictions in that it has a legislative system consistent with English Common law. DIFC has its own set of civil and commercial laws and regulations. It has developed a complete code of law governing financial services regulations. As part of its autonomy, DIFC has created an independent judicial system. The DIFC Courts is the entity responsible for the independent administration and enforcement of justice in DIFC. The Courts have exclusive jurisdiction over all civil and commercial disputes arising within DIFC and/ or relating to bodies and companies registered in DIFC.